Guyana High Court Rejects Bid To Halt Extradition Proceedings Against Nazar And Azruddin Mohamed

News Americas, Georgetown, Guyana, Jan. 6, 2026: Guyana’s High Court has refused an application by businessmen Nazar Mohamed and his son, leader of the WIN, political party and presumed opposition leader, Azruddin Mohamed, to halt ongoing extradition proceedings in the Magistrate’s Court while their constitutional challenge to the country’s extradition laws is determined.

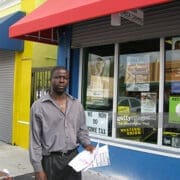

FLASHBACK – Azruddin Mohamed stands with his lawyers outside the Georgetown Magistrates’ Court during his ongoing US extradition proceedings.

In a ruling delivered today, Acting Chief Justice Navindra Singh, found that the applicants failed to satisfy the high legal threshold required for an interim stay of the committal proceedings, which are currently before Judy Latchman. The extradition hearings are set to continue on Tuesday.

The extradition request was initiated by the United States Government under the 1931 Extradition Treaty between the United States of America and Great Britain. Following an Authority to Proceed issued by Guyana’s Minister of Home Affairs, the Mohameds were arrested on October 31, 2025, and later released on bail pending the outcome of the committal proceedings.

Before the Magistrate’s Court, the applicants challenged the constitutionality of the Fugitive Offenders (Amendment) Act 2009 and sought a referral of constitutional questions to the High Court. That application was rejected by Magistrate Latchman, who ruled that the issues raised were frivolous and vexatious. The Mohameds subsequently filed a Fixed Date Application in the High Court and requested a stay of the extradition process.

In refusing the stay, Chief Justice Singh stressed that the filing of constitutional proceedings does not automatically suspend parallel statutory processes. He noted that stays in extradition matters are “exceptional, not routine,” and outlined three guiding considerations: whether the constitutional challenge raises serious and arguable issues, whether irreparable prejudice would result if proceedings continue, and where the balance of convenience lies between private rights and the public interest.

Addressing the applicants’ arguments, the Court rejected claims that the 2009 amendments unlawfully permit the Minister to bypass judicial oversight. The Chief Justice ruled that the legislation allows the Minister only to determine whether extradition proceedings should commence, while the courts retain full authority over committal hearings. He found no evidence that the Minister had attempted to circumvent judicial scrutiny in this case.

The Court also dismissed arguments that the amendments improperly cure alleged deficiencies in the 1931 treaty, including the absence of an express safeguard against onward extradition to a third state. Chief Justice Singh observed that such protection may exist by implication within the treaty and, in any event, noted that the United States has provided written assurances that the Mohameds would not be extradited to a third country without Guyana’s consent.

On claims relating to access to justice, the Chief Justice found no merit in the contention that the amendments restrict judicial remedies. He pointed out that safeguards such as habeas corpus remain available should the applicants be committed for extradition.

The Court further held that no irreparable harm would arise from allowing the committal proceedings to continue, noting that extradition hearings are preliminary in nature and do not determine guilt or innocence. Chief Justice Singh emphasized that no surrender order is imminent and that the substantive constitutional challenge is scheduled to be heard next week.

Balancing the competing interests, the Chief Justice concluded that the public interest in upholding Guyana’s international obligations and preventing abuse of constitutional litigation outweighed the applicants’ request for interim relief. He cautioned that routinely granting stays in extradition cases could undermine confidence in the administration of justice.

The application for a stay was therefore refused, with costs awarded. The substantive constitutional challenge is scheduled to be heard on January 14, 2026.