News Americas, TORONTO, Canada, Mon. Oct. 6, 2025: Guyana is navigating one of the most extraordinary moments in its modern history. With vast new oil discoveries transforming its economic outlook almost overnight, the country has embarked on an ambitious program of investment, social development, and national security. The stakes are high: how to turn a sudden torrent of resource wealth into durable, broad-based national advantage, while facing both external threats and internal challenges.

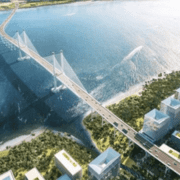

An artist’s impression of the New Demerara River Bridge commissioned on Sunday, October 5, 2025 in Guyana. (DPI image)

The September 1st general election, which returned the People’s Progressive Party/Civic (PPP/C) with a strong mandate, confirms that the majority of Guyanese want continuity in the government’s development strategy. For the first time in decades, the old patterns of strictly race-based voting gave way to a more issue-driven electorate. The PPP/C, traditionally rooted in the Indo-Guyanese community, won about 55% of the vote, in a country where that community makes up roughly 35% of the population. This widening base, alongside the emergence of the WIN party, reflects a population increasingly judging parties on their economic vision and ability to deliver.

Building the Foundations of Transformation

One of the most visible symbols of this transformation came on Sunday, when the long-awaited bridge over the Demerara River opened. This project, which will replace the aging floating bridge, stands as a centerpiece of Guyana’s broader infrastructure push. By improving connectivity between the capital and key economic zones, it promises to slash transport times, boost commerce, and integrate communities more closely into the national economy.

The bridge is only one part of a wider strategy. Drawing from both the National Development Strategy and the Low Carbon Development Strategy, Guyana is using oil revenues to accelerate investments in roads, ports, housing, hospitals, and schools. Social programs — from cash transfers to education initiatives – are designed not just to share the wealth, but to invest in long-term human capacity.

The government’s message is clear: this is not a squandered boom, but a carefully sequenced plan. Oil money is being directed into a sovereign wealth fund, with rules and oversight mechanisms to ensure spending is sustainable. The goal is to convert today’s windfall into tomorrow’s permanent uplift.

Defending Wealth, Protecting Sovereignty

Alongside these economic ambitions is a pressing reality: Guyana must protect its newfound wealth. Venezuela’s persistent claims on Guyana’s Essequibo region — and by extension, its offshore oil fields — have forced Georgetown to integrate defence directly into its development agenda.

Defence and economics are now inseparable. Offshore patrols, maritime security, and alliances with partners such as the United States are being reinforced to safeguard critical assets. But here too, Guyana is looking for models that combine urgency with nation-building. Drawing lessons from countries like Canada, it is exploring how defence contracts can be structured to build local industry, transfer skills, and expand domestic supply chains under firm civilian oversight.

Learning from Global Practice

Guyana’s situation is unique in scale and timing, but not without precedent. Canada’s use of public procurement to strengthen domestic industries during periods of expansion offers useful parallels. Guyana could, for example, phase local content requirements into mega-projects, ensuring that oil money not only builds roads and bridges, but also trains welders, engineers, and project managers who can sustain development long after the oil has peaked.

Workforce development is particularly urgent. Building technical colleges and apprenticeship schemes tied directly to major infrastructure and energy projects would ensure that young Guyanese gain the skills to participate in, and sustain, the transformation. The government has already begun linking housing construction and vocational training, a model that could expand across multiple sectors.

Sequencing and Capacity

The challenge is not lack of ambition, but the risk of overload. Oil revenues are flowing in at a speed few countries have experienced, and the temptation to spend rapidly is ever-present. The government has recognized the importance of sequencing – ensuring that procurement, project management, and oversight systems expand in step with new commitments. Independent fiscal oversight and phased project requirements are being emphasized to keep the sprint from turning chaotic.

In other words, Guyana is racing ahead – but trying to run its sprint like a marathon. That means pacing the rollout of projects, building institutional capacity alongside physical capacity, and resisting the pitfalls that have trapped other resource-rich nations.

The Promise Ahead

The victory on September 1st has given the PPP/C another five years to prove that this model can work. The opening of the Demerara bridge is both a milestone and a metaphor: a structure that connects communities and commerce, built with the revenues of a new era, and designed to last for generations.

Guyana’s path is not without risks. Venezuelan threats, the dangers of overspending, and the social strains of rapid change will test the government’s resolve. But the signs so far suggest that the country is taking the long view, guided by national strategies that balance development, sustainability, and sovereignty.

If Guyana can maintain that discipline, it may succeed where so many resource-rich nations have faltered. It may turn urgency into advantage — and transform an oil boom into a national renaissance.

EDITOR’S NOTE: Ron Cheong, born in Guyana, is a community activist and dedicated volunteer with an extensive international background in banking. Now residing in Toronto, Canada, he is a fellow of the Institute of Canadian Bankers and holds a Bachelor of Science degree from the University of Toronto.