2025’s Freest Caribbean Economies: The Region’s Bright Spots and Challenges

By NAN Business Editor

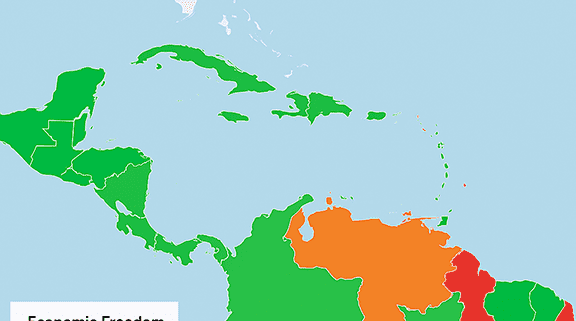

News Americas, TORONTO, Canada, Fri. Oct. 11, 2025: The Caribbean’s 2025 Index of Economic Freedom paints a complex picture of progress and persistence – where fiscal health and innovation are rising, but corruption and weak institutions continue to hold some nations back from freer Caribbean economies.

The Washington-DC-based, Heritage Foundation’s Index of Economic Freedom, now in its 31st edition, evaluates 184 economies worldwide annually, using four key pillars: Rule of Law, Government Size, Regulatory Efficiency, and Open Markets. Each pillar includes 12 indicators — from property rights and judicial integrity to labor freedom and fiscal health – measured on a scale from 0 to 100.

The Freest and Most Repressed Caribbean Economies in 2025

No Caribbean economy ranks as “free” in the 2025 report. Instead, most fall within the “moderately free” category, while others remain “mostly unfree” or “repressed.” The data, drawn from the first half of 2023 through the second half of 2024, reveals that while fiscal discipline is improving in several countries, challenges such as public debt, corruption, and unemployment continue to shape the region’s economic landscape.

The Freest Caribbean Economies For 2025

1️⃣ Barbados (Score: 68.9 | Global Rank: 36)

Barbados tops the region for 2025, earning a “moderately free” status with strong scores in judicial effectiveness and tax policy. However, its growing public debt remains a looming concern for long-term stability.

2️⃣ Jamaica (Score: 68.7 | Global Rank: 38)

Jamaica continues to attract investment and ranks among the world’s top 40 economies for freedom. While it benefits from an open business environment, corruption and high government spending still hinder deeper reforms.

3️⃣ Saint Lucia (Score: 67.0 | Global Rank: 47)

Saint Lucia’s ease of doing business and moderate regulatory efficiency secure its place among the top three. Yet, high unemployment and fiscal pressures continue to slow its progress toward greater economic independence.

4️⃣ Dominican Republic (Score: 64.3 | Global Rank: 65)

With a diverse economy and consistent growth, the Dominican Republic’s strong tax management boosts its standing. However, government integrity and inefficient regulations remain key areas for improvement.

5️⃣ Belize (Score: 64.2 | Global Rank: 66)

Belize’s fiscal health and moderate inflation levels reflect steady economic management. Persistent issues like corruption and weak property rights, however, undermine investor confidence.

6️⃣ Trinidad and Tobago (Score: 63.6 | Global Rank: 69)

Rich in energy resources, Trinidad and Tobago enjoys solid fiscal health but struggles with corruption and limited property rights. Diversification remains essential for sustainable growth.

7️⃣ The Bahamas (Score: 63.2 | Global Rank: 72)

The Bahamas boasts strong property rights and no income tax, giving it a competitive edge. Still, high debt and trade barriers restrain its full potential.

8️⃣ Saint Vincent & the Grenadines (Score: 60.1 | Global Rank: 87)

Moderately free but weighed down by limited financing access and unemployment, St. Vincent and the Grenadines remains on the cusp of greater freedom if reforms deepen.

The Somewhat Repressed Caribbean Economies

Guyana (Score: 58.2 | Global Rank: 99)

Despite its booming oil sector, Guyana remains “mostly unfree.” Weak rule of law, corruption, and governance gaps continue to overshadow fiscal progress and rapid GDP growth.

Dominica (Score: 55.3 | Global Rank: 116)

Dominica maintains judicial stability but suffers from inefficient spending and rigid labor policies that restrict competitiveness.

Suriname (Score: 50.9 | Global Rank: 144)

Suriname remains “mostly unfree” with high inflation, corruption, and weak rule of law undermining public trust and investment.

The Repressed Caribbean Economies

Haiti (Score: 48.8 | Global Rank: 153)

At the bottom of the regional list, Haiti ranks among the world’s most repressed economies. Endemic corruption, insecurity, and weak institutions continue to paralyze progress and repel investment.

Cuba (Score: 25.4 | Global Rank: 175th)

Cuba remains classified as “repressed,” with pervasive state control over markets, severely restricted property rights, and limited financial freedom. Structural barriers to private enterprise and foreign investment keep its overall score among the lowest worldwide.

The Big Picture

Across the Caribbean, economic freedom ranges from moderately free to repressed, reflecting both the gains of reform and the drag of persistent challenges. Fiscal responsibility and openness to trade are improving, yet issues of governance, transparency, and institutional weakness remain the biggest barriers to unlocking regional prosperity.

As the Heritage Foundation’s Index reminds policymakers, sustainable growth depends not only on attracting investment but on building trustworthy institutions that support fairness, accountability, and opportunity for all.

(Ramotsamai Itumeleng Khunyeli contributed to this story.)

Leave a Reply

Want to join the discussion?Feel free to contribute!