Why This Caribbean Territory’s Crypto Bet Isn’t About Bitcoin

By NAN Business Editor

News Americas, DAVOS, Switzerland, Weds. Jan. 21, 2026: While global headlines frame one Caribbean territory’s latest move as a bold “crypto bet,” the island’s real play is far more pragmatic – and far more Caribbean.

The Government of Bermuda has announced its plans to transform Bermuda into the world’s first fully on-chain national economy with support from Circle and Coinbase.

Bermuda, a British overseas territory, isn’t chasing crypto culture. It’s trying to escape the quiet tax that small island economies pay every day: punitive banking costs, slow cross-border payments, and shrinking merchant margins.

At the World Economic Forum this week, Bermuda announced plans to become the world’s first fully on-chain national economy, partnering with Circle and Coinbase. But beneath the buzzwords lies a familiar Caribbean problem – and a strategic response other territories are watching closely.

The Hidden Cost Of Being an Island Economy

For decades, Caribbean jurisdictions have been lumped into “high-risk” banking categories, regardless of compliance strength. The result:

Higher merchant fees

Delayed settlements

Limited access to international payment processors

and constant de-risking pressure on local banks

For small and medium-sized businesses, especially in tourism and services, traditional payment rails quietly drain revenue. Bermuda’s move to an on-chain economy using USDC isn’t about replacing the dollar -— it’s about accessing it more efficiently.

With stablecoin payments, Bermudian merchants can accept fast, dollar-denominated transactions without the layers of correspondent banking fees that have long punished island economies simply for being islands.

Why This Matters Beyond Bermuda

What makes Bermuda different isn’t the technology – it’s the groundwork.

The territory has spent nearly a decade building regulatory credibility, becoming one of the first jurisdictions globally to implement a comprehensive digital asset framework under its Digital Asset Business Act in 2018. Circle and Coinbase were early licensees, growing alongside the island’s regulated ecosystem. That regulatory maturity is why Bermuda can experiment at a national scale while many Caribbean governments remain stuck between fear of de-risking and fear of innovation.

The recent USDC airdrop at the Bermuda Digital Finance Forum – 100 USDC to every attendee for use at local merchants – wasn’t a gimmick. It was a live stress test of whether digital finance could circulate value locally, not siphon it offshore.

A Caribbean Test Case For The Future of Money

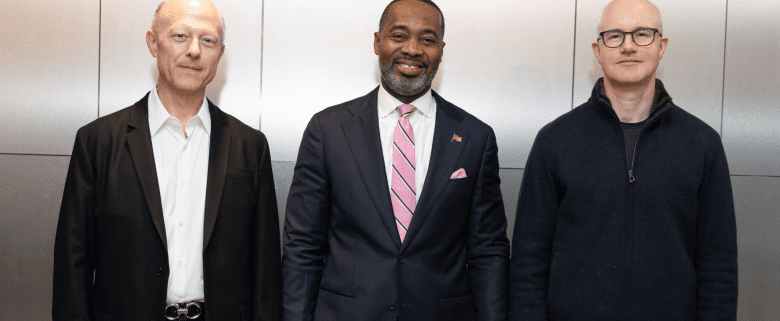

Premier David Burt has framed the initiative as a collaboration between government, regulators, and industry – a model that reflects Bermuda’s long-standing approach to financial services. “Bermuda has always believed that responsible innovation is best achieved through partnership between government, regulators, and industry,” said Premier Burt. “With the support of Circle and Coinbase, two of the world’s most trusted digital finance companies, we are accelerating our vision to enable digital finance at the national level. This initiative is about creating opportunity, lowering costs, and ensuring Bermudians benefit from the future of finance.”

“Bermuda has been a global pioneer in digital asset regulation and continues to demonstrate what responsible blockchain innovation looks like at a national scale,” said Circle Co-Founder, Chairman, and CEO, Jeremy Allaire. “We are proud to deepen our engagement as Bermuda empowers people and businesses with USDC and onchain infrastructure.”

“Coinbase has long believed that open financial systems can drive economic freedom,” said Coinbase CEO Brian Armstrong. “Bermuda’s leadership shows what is possible when clear rules are paired with strong public-private collaboration. We are excited to support Bermuda’s transition toward an onchain economy that empowers local businesses, consumers, and institutions.”

If successful, Bermuda’s experiment could offer a blueprint for other Caribbean territories grappling with the same structural constraints but lacking Bermuda’s regulatory head start. The real question isn’t whether crypto works. It’s whether on-chain finance can finally level a global system that has never been fair to small island economies.

For the Caribbean, Bermuda’s bet may signal not a leap into the future – but a long-overdue correction of the past.

Leave a Reply

Want to join the discussion?Feel free to contribute!